Higher borrowing costs continued to impact home sales in June 2022. The Toronto Regional Real Estate Board reported that sales totaled 6,474 – down by 41 per cent compared to last year’s strong result. The number of transactions was also down compared to May 2022, but this is often the case due to the seasonal nature of the market.

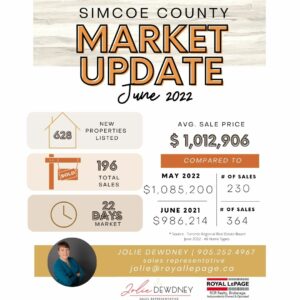

The average sales price in the City of Toronto has dropped slightly since May but still showed an increase compared to June 2021. In Simcoe County, the average sales price also dropped since last month but again was higher than June of last year. York Region’s average sales price was down since May but recorded an increase over June of 2021. More detailed information on each of these areas follows below.

“Home sales have been impacted by both the affordability challenge presented by mortgage rate hikes and the psychological effect wherein home buyers who can afford higher borrowing costs have put their decision on hold to see where home prices end up. Expect current market conditions to remain in place during the slower summer months. Once home prices stabilize, some buyers will re-enter the market despite higher borrowing costs,” said TRREB President Kevin Crigger.

While the number of transactions was down year-over-year, the number of new listings was little changed over the same period. This has provided for more balance in the market, resulting in a more moderate annual pace of price growth.

“Listings will be an important indicator to watch over the next few months. With the unemployment rate low, the majority of households aren’t in a position where they need to sell their home. If would-be sellers decide to take a wait-and-see attitude over the next few months, it’s possible that active listings could trend lower as well. This could cause market conditions to tighten somewhat, providing some support for home prices,” said TRREB Chief Market Analyst Jason Mercer.

“Our region continues to grow because we attract people and businesses from all around the world. All of these people will require a place to live, whether they choose to buy or rent. Despite the shorter-term impact of higher borrowing costs, housing demand will remain strong over the long-term, as long as we can produce homes within which people can live. Policymakers at all levels need to make this their key goal,” said TRREB CEO John DiMichele.

If you have questions about the real estate market, or are thinking about buying or selling and are not sure where to start, please reach out and I would be happy to assist you!